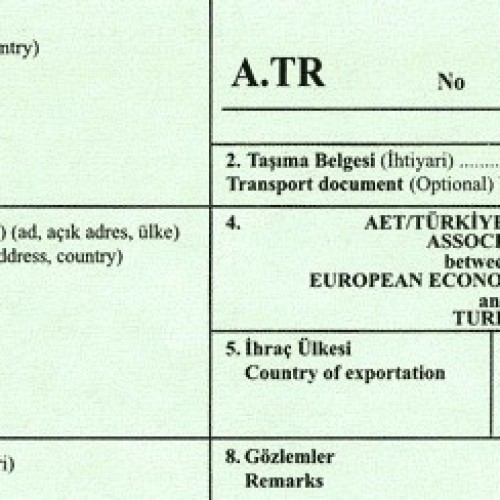

A. TR MOVEMENT CERTIFICATE – BASIC PRINCIPLES FOR TURKISH IMPORTERS SIDE

Sezai KAYA, Customs Consultant, Former Customs Inspector

3 March 2021

In this article, basic rules to be followed about A.TR Movement Certificates will be discussed.

1) A.TR Movement Certificate is issued for processed agricultural and industrial products directly transported between two parts of the Customs Union Territory.

This certificate cannot be issued for the products scope of the European Coal and Steel Community Agreement.

2) If A.TR Movement Certificate is not issued due to reasons such as forgetting or negligence during the export of the goods, it is possible to issue it after the export of the goods.

3) In case of rejection due to technical reasons or change of destination country, A.TR Movement Certificate can be issued after the export of the goods.

In the event that A.TR Movement Certificate is rejected due to technical reasons, preferential regime is not applied to the goods within the Customs Union and taxes are collected.

In this case, 3-fold penalty is not applied within the scope of Article 234/1-a of the Customs Law No. 4458.

4) Second copy (dublicate) of A.TR Movement Certificate can be issued if it is stolen, lost or damaged.

5) A.TR Movement Certificate has to be submitted to the customs administration of the importing country within four months from the date of visa by the customs administration of the exporting country.

6) It is obligatory to submit A.TR Movement Certificate , which has the phrase ” Issued Retrospectively”, to the importer customs administration within four months from the visa date of the exporter customs administration.

7) A.TR Movement Certificate issued in accordance with the Simplified Transaction Procedures has to be submitted by the importer to the customs administration within four months from the actual date of export specified in the circulation document.

For example, if customs visa column of A.TR Movement Certificate is approved by the customs administration before the actual export, the submission period of the document is four months from the actual date of export.

The customs administration may have already visa the blank A.TR Movement Certificate before the export. Let's assume that there is the date 10 October 2020 in the customs visa section. For the goods actually exported on 10 December 2020, A.TR Movement Certificate can be submitted until 10 April 2021.

8) It is obligatory that A.TR Movement Certificate, which has phrase “Dublicate”, has to be submitted to the importer’s customs office within four months from the visa date of the exporter customs administration of first A.TR Movement Certificate

It is important that 4-month period starts from the visa date of first certificate.

9) In other cases, where the submission of the document is delayed, A.TR Movement Certificate is accepted on the condition that the goods are submitted to the relevant customs office in due time.

For example, validity period of A.TR Movement Certificate of the goods placed in the warehouse, free zone and temporary storage areas before the expiry of 4 months will be considered as frozen. Even if the goods are imported after 2 years from the mentioned places, A.TR Movement Certificate will be accepted.

10) If A.TR Movement Certificate cannot be submitted at the time of import, taxes are collected.

However, if an appropriate A.TR Movement Certificate is submitted within 1 year after the importation of the goods, customs duty is refunded.

11) Obvious mistakes, such as minor differences between A.TR Movement Certificate and the documents submitted, or typing mistakes that do not cause suspicion, do not necessitate the rejection of these documents.

For example, while the weight of the goods is written 9,842 kg in all documents, it says 8,942 kg in A.TR Movement Certificate .

12) Non-commercial goods brought with the passenger from one part of the Customs Union to another part are accepted in free circulation and A.TR Movement Certificate is not required.

14) Preferential proof of origin documents can be submitted for goods of European Community origin coming from the Pan-European Cumulation, Pan-Euro-Mediterranean Cumulation, Western Balkans Cumulation countries and preferential tariff is applied.

For example, a proof of origin (EUR.1, EUR.MED etc.) can be submitted for goods of Italian origin coming from Tunisia. Preferential tariffs are applied to this item as if an A.TR Movement Certificate was handed in.

15) The preferential origin status of the Pan-European cumulation, Pan-Euro-Mediterranean Cumulation, Western Balkans Cumulation countries origin goods coming from the European Community is proven by the suppliers’ declaration.

For example, a supplier’s declaration has to be submitted for Icelandic origin goods coming from the Netherlands in order not to pay additional customs duty.

Yazı Kategorileri

GÜNCEL YAZILAR

- GEÇİCİ İTHAL EDİLEN AMBALAJLARIN BAŞKA FİRMALAR TARAFINDAN YENİDEN İHRACI

- KULLANIM YERİNE GÖRE TARİFE SINIFLANDIRMASI – KAHVE MAKİNASI ÖRNEĞİ

- İHTİRAZİ KAYITLA BEYANIN VERİLMESİ GEREKEN SÜRE

- ÖZET BEYAN – DOĞRUDAN NAKLİYAT

- KARGO YOLUYLA GETİRİLEMEYECEK MALLAR

- GÜMRÜĞE SUNULAN EŞYA – İŞLEM YAPMA SÜRESİ – TASFİYE – CIF %1

- SİTRİK ASİT TURŞUYA, GÜMRÜK CEZASI BİZE TEMAS ETTİ

- VARSAYIMA DAYALI CEZALAR – UMUMHANEDE HASILAT TESPİTİ

- TESPİTİ KİMİN YAPTIĞINA GÖRE KAÇAKÇILIK

- YYS ALIM KARARI VERMEDEN ÖNCE – DÜŞÜNÜN

- İHRAÇ KAYITLI SATIŞ – SÜRE SONU – DAHİLDE İŞLEME

- İMALATÇI FATURASININ İHRACATTAN SONRAKİ TARİHLİ OLMASI

- GÜMRÜKTE FİNANSAL HAMLELER

- KAYIT BELGESİ UYGULAMASINDA ÖNGÖRÜLEMEZLİK ve HUKUKİ BELİRSİZLİK

- ANTREPODA ELLEÇLEME – ÜÇÜNCÜ ÜLKE MENŞELİ MALLAR – GÜMRÜK VERGİSİ

- KAYIT BELGESİ – KIYMET FARKI – CEZA

- DAHİLDE İŞLEME- BEYANNAME KAPATMA SÜRESİ – SÜRE KAZANMA

- GÜMRÜK DUVARLARININ YÜKSELMESİ – ANTREPODAN TRANSİT TİCARET

- SONRADAN GTİP DEĞİŞİKLİĞİ – ÜRÜN GÜVENLİĞİ DENETİMLERİ

- MÜFREZ (BÖLÜNMÜŞ) BEYANNAME

- ALDATICI İŞLEMİN TANIMI YAPILMALI – SINIRLARI ÇİZİLMELİ

- YOLCU BERABERİ NUMUNELİK EŞYA

- ELEKTRONİK TEBLİGATI FARKETMEMEK ve GÜMRÜK ALACAĞININ KESİNLEŞMESİ

- TİCARETİN KOLAYLAŞTIRILMASI – GÜMRÜK – BAZI ÖNERİLERİM

- KONSİNYE İHRACAT – BEDEL GETİRME SÜRESİ