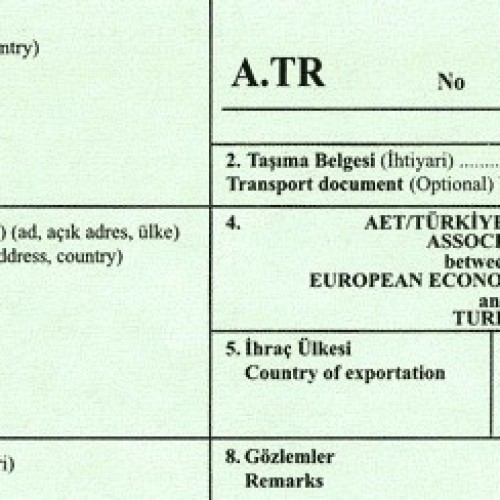

A. TR MOVEMENT CERTIFICATE – BASIC PRINCIPLES FOR TURKISH IMPORTERS SIDE

Sezai KAYA, Customs Consultant, Former Customs Inspector

3 March 2021

In this article, basic rules to be followed about A.TR Movement Certificates will be discussed.

1) A.TR Movement Certificate is issued for processed agricultural and industrial products directly transported between two parts of the Customs Union Territory.

This certificate cannot be issued for the products scope of the European Coal and Steel Community Agreement.

2) If A.TR Movement Certificate is not issued due to reasons such as forgetting or negligence during the export of the goods, it is possible to issue it after the export of the goods.

3) In case of rejection due to technical reasons or change of destination country, A.TR Movement Certificate can be issued after the export of the goods.

In the event that A.TR Movement Certificate is rejected due to technical reasons, preferential regime is not applied to the goods within the Customs Union and taxes are collected.

In this case, 3-fold penalty is not applied within the scope of Article 234/1-a of the Customs Law No. 4458.

4) Second copy (dublicate) of A.TR Movement Certificate can be issued if it is stolen, lost or damaged.

5) A.TR Movement Certificate has to be submitted to the customs administration of the importing country within four months from the date of visa by the customs administration of the exporting country.

6) It is obligatory to submit A.TR Movement Certificate , which has the phrase ” Issued Retrospectively”, to the importer customs administration within four months from the visa date of the exporter customs administration.

7) A.TR Movement Certificate issued in accordance with the Simplified Transaction Procedures has to be submitted by the importer to the customs administration within four months from the actual date of export specified in the circulation document.

For example, if customs visa column of A.TR Movement Certificate is approved by the customs administration before the actual export, the submission period of the document is four months from the actual date of export.

The customs administration may have already visa the blank A.TR Movement Certificate before the export. Let's assume that there is the date 10 October 2020 in the customs visa section. For the goods actually exported on 10 December 2020, A.TR Movement Certificate can be submitted until 10 April 2021.

8) It is obligatory that A.TR Movement Certificate, which has phrase “Dublicate”, has to be submitted to the importer’s customs office within four months from the visa date of the exporter customs administration of first A.TR Movement Certificate

It is important that 4-month period starts from the visa date of first certificate.

9) In other cases, where the submission of the document is delayed, A.TR Movement Certificate is accepted on the condition that the goods are submitted to the relevant customs office in due time.

For example, validity period of A.TR Movement Certificate of the goods placed in the warehouse, free zone and temporary storage areas before the expiry of 4 months will be considered as frozen. Even if the goods are imported after 2 years from the mentioned places, A.TR Movement Certificate will be accepted.

10) If A.TR Movement Certificate cannot be submitted at the time of import, taxes are collected.

However, if an appropriate A.TR Movement Certificate is submitted within 1 year after the importation of the goods, customs duty is refunded.

11) Obvious mistakes, such as minor differences between A.TR Movement Certificate and the documents submitted, or typing mistakes that do not cause suspicion, do not necessitate the rejection of these documents.

For example, while the weight of the goods is written 9,842 kg in all documents, it says 8,942 kg in A.TR Movement Certificate .

12) Non-commercial goods brought with the passenger from one part of the Customs Union to another part are accepted in free circulation and A.TR Movement Certificate is not required.

14) Preferential proof of origin documents can be submitted for goods of European Community origin coming from the Pan-European Cumulation, Pan-Euro-Mediterranean Cumulation, Western Balkans Cumulation countries and preferential tariff is applied.

For example, a proof of origin (EUR.1, EUR.MED etc.) can be submitted for goods of Italian origin coming from Tunisia. Preferential tariffs are applied to this item as if an A.TR Movement Certificate was handed in.

15) The preferential origin status of the Pan-European cumulation, Pan-Euro-Mediterranean Cumulation, Western Balkans Cumulation countries origin goods coming from the European Community is proven by the suppliers’ declaration.

For example, a supplier’s declaration has to be submitted for Icelandic origin goods coming from the Netherlands in order not to pay additional customs duty.

Yazı Kategorileri

GÜNCEL YAZILAR

- GÖZETİM FARKI – İHTİRAZİ KAYITLA BEYAN – VERGİLERİN GERİ ALINABİLMESİ

- ANTREPODAN TRANSİT TİCARETLERDE HASILATIN KAYDEDİLECEĞİ DÖNEM

- DAHİLDE İŞLEME – SERBEST BÖLGELERE İHRACAT – FASON İŞLEMLER

- BİR SATIN ALMA KARARINDAN ÖNCE GÜMRÜK YÖNÜYLE YAPILMASI GEREKENLER

- KEFALET SİGORTASI ve GÜMRÜKTE TEMİNAT

- İHRACAT BEDELLERİNİ GETİRME ZORUNLULUĞU – MAHSUPLAŞMA

- ÜÇÜNCÜ ÜLKE MENŞELİ EŞYALARDAN, AB MENŞELİ GİRDİLERİN DÜŞÜLMESİ

- BILL TO TÜRKİYE SHIP TO ABROAD

- BANDROL YAPIŞTIRMA ZORUNLULUĞU

- BEYAN, REFERANS FİYATIN ALTINDA KALIRSA

- KAYIT BELGESİ – GTİP DEĞİŞİKLİĞİ

- RUSYA -KKDF – İHRACAT BEDELLERİ

- İTHALAT BEDELİNİN TÜRKİYE’DEKİ HESAPLARA ÖDENMESİ

- TRANSİT REJİMİNDE BEYANDA OLMAYAN EŞYAYA CEZA UYGULAMASI

- BİR ARBİTRAJ FIRSATI : KKDF vs FAİZ

- GÖZETİM – KDV İNDİRİMİ – ÖRNEK

- AĞIRLIKTAN ALINAN VERGİLER ve NET – BRÜT AĞIRLIK

- GÜMRÜĞE ÖDENEN KDV – İNDİRİLECEK KDV MUAMMASI

- TOPLU TEMİNAT – GÖTÜRÜ TEMİNAT

- TASFİYELİK EŞYA – CIF %1 – BEYANNAME İPTALİ VE YENİ BEYANNAME TESCİLİ

- YATIRIM TEŞVİK KAPSAMI MAKİNENİN DEĞİŞTİRİLMESİ

- MENŞE İSPAT VE DOLAŞIM BELGELERİNİN SONRADAN KONTROLÜ VE TEMİNAT

- TAKLİT ÜRÜN İTHALİNE KARŞI GÜMRÜĞE BAŞVURU

- DAHİLDE İŞLEME – EŞDEĞER EŞYA KULLANIMI YASAĞI ve STOK BAKİYESİ

- DAHİLDE İŞLEME – ÇEVRE KATKI PAYI